State of the Industry

Restoration & Remediation Presents the 2024 R&R 360 Industry Outlook

Giving the Industry a complete guide to Restoration, Remediation and Cleaning Trends

Over the years, Restoration & Remediation Magazine has brought the industry a summary of what has happened over the last year in our industry, as well as trends to keep an eye on. As a new initiative, we have changed the name of the report from “The State of The Industry,” to “The R&R 360 Industry Outlook.” Previous studies, and speaking with industry professionals at various trade shows, has taught us that adding the perspective of the homeowner could help build better business practices and potentially help restoration contractors profit financially, providing a comprehensive view of the market landscape.

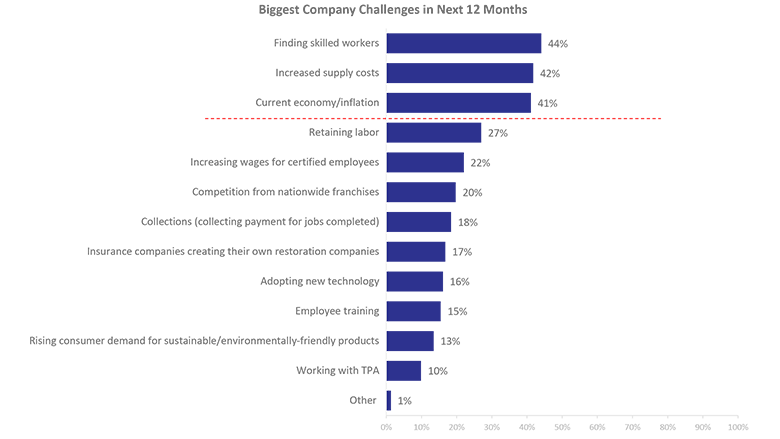

Uniquely, this year, a panel of four industry leaders joined Restoration & Remediation Magazine to do a further dive into the key findings and more in an exclusive, thought-provoking webinar. These key findings include finding skilled workers, followed by increased supply costs, and the current economy/inflation.

The Contractor's Role

Consistent with our findings in 2022, half of respondents are primarily involved with remodeling contracting, while just under one-fifth are involved with water damage restoration contracting. Median company revenue is between $1 million and $4.9 million. The majority of respondent companies provide water restoration services, followed by mold remediation, fire/smoke damage restoration, cleaning and disinfection, and odor removal.

The majority of contractors are independent and serve in management roles; about three-fifths approve or authorize purchases for their company.

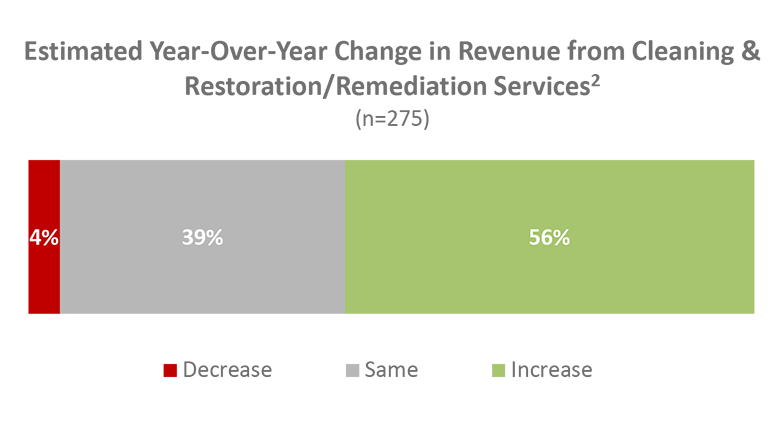

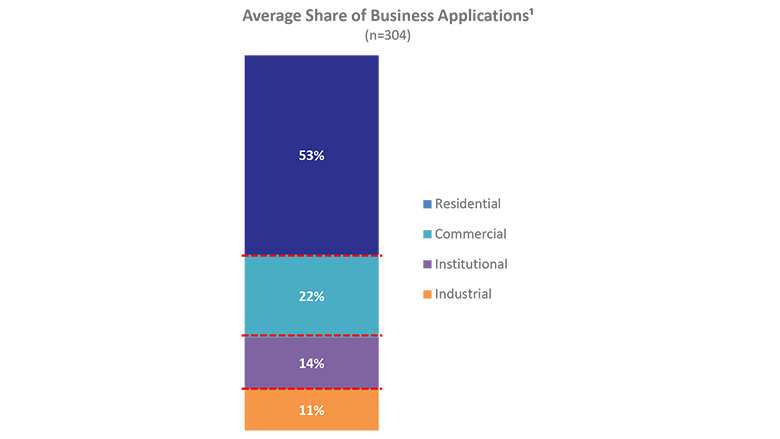

Most respondents are optimistic about the business going forward. Fifty six percent of respondents estimate that business revenue from restoration and remediation projects will increase in the future. Residential contractors are especially enthusiastic about growth potential for their business, with 53 percent of respondents expecting an increase. Twenty-two percent of commercial contractors expect an increase, with 14 percent of institutional contractors seeing an increase.

On average, over half of contractors’ business is generated from residential projects. More than half of contractors predict an increase in revenue from restoration and remediation work in 2024 compared to last year.

Finding Skilled Workers

For the past 2 years, the largest perceived challenge in the industry is finding skilled workers. This year Restoration & Remediation sent out a questionnaire covering a range of topics affecting the restoration business, again with a 360 view from both contractors and homeowners. These included hiring and retention, sustainability initiatives etc. from the contractor’s perspective, to methods of seeking out restoration work and purchase decision factors for the homeowner.

Contractors report spending an average of 33 percent of last year’s budget on labor.

Companies employ a mix of full-time, part-time and contract employees. More than half of contractors report no change in staffing level across the board over the past year; however, two-in-five report an increase in subcontractors.

This could be because of the current worker retention. About half of contractors have worked at their current company for over 10 years. The majority of contractors see a path to advance in their career and company. In three years, the majority of contractors not only continue to see themselves in the restoration industry but also with their current company.

Even with companies retaining the same employees for over 10 years and implementing retention initiatives such as increasing employees’ pay/awarding bonuses to increase that retention. Finding properly “skilled” employees, again, remains to be a major challenge.

During the R&R 360 industry panel discussion, panelists were asked why they believe this is; the conversation of training became one of the main points. Executive Vice President of NORMI Lance Eisen, one of the four industry expert panelists, stated that training workers to meet the expectation of the customer is the key.

Studies have shown that the majority of contractors believe it is highly important to provide quality staff training. An average of 14 percent of company annual budgets spent are on training. Hands-on training is the top preferred training method of technical competency, followed by on-site field training. Notably, training is within the top five methods of employee retention, a consistent factor in the restoration industry.

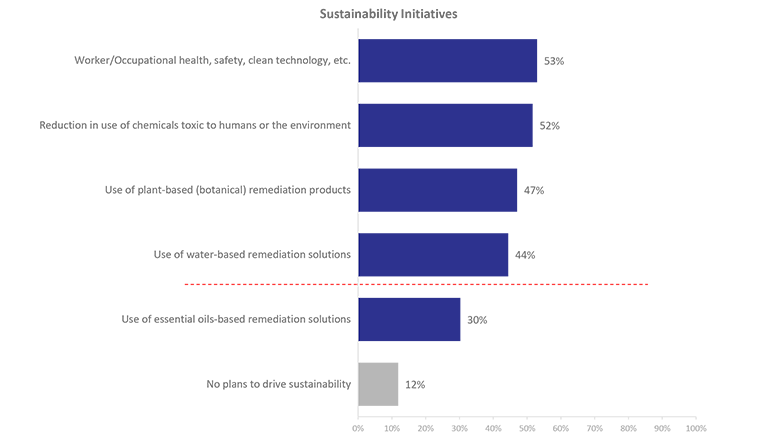

Another key finding during this study is sustainability initiatives. The majority of contractor companies plan to drive sustainability, with over half planning to do so by ensuring worker safety and reducing toxic chemical usage, a topic that spills into another area of interest: Inflation and supply chain demand, another one of the biggest challenges for restorers over the past year.

Planned purchases for the next 12 months are estimated at an average of about three categories of chemical/products purchased and four categories of equipment/services purchased. On average respondents spent 14 percent on restoration equipment, and 15 percent on remediation chemicals.

The Homeowner's Expectations

As aforementioned, this year’s findings have an extra boost of bettering your restoration business as it includes the perspective of the homeowner. During the R&R 360 panel discussion, Doug Hoffman Founder and director of NORMI stated that often times there is a disconnect between what restorers think a homeowner wants and needs vs what they’re actually thinking and wanting when hiring business.

The majority of respondents (70%) were male. Baby Boomers made up the biggest age group with 45 percent of respondents born between 1946 and 1965.

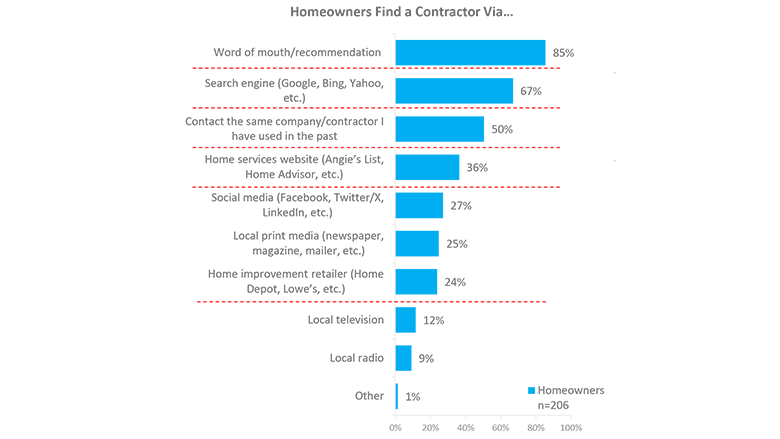

Homeowners indicate they are most likely to seek out a cleaning, restoration and remediation company via word of mouth, followed by search engines and contacting previous companies.

Similarly, contractors’ main method of promotion is word of mouth. Contractors are also highly likely to be advertising via social media, but that is a relatively low method for homeowners.

While social media may not be the preferred method of acquiring services for homeowners, online reviews are highly important, ranking high at 72 percent. Most contractors are featuring their own reviews from previous customers on their websites.

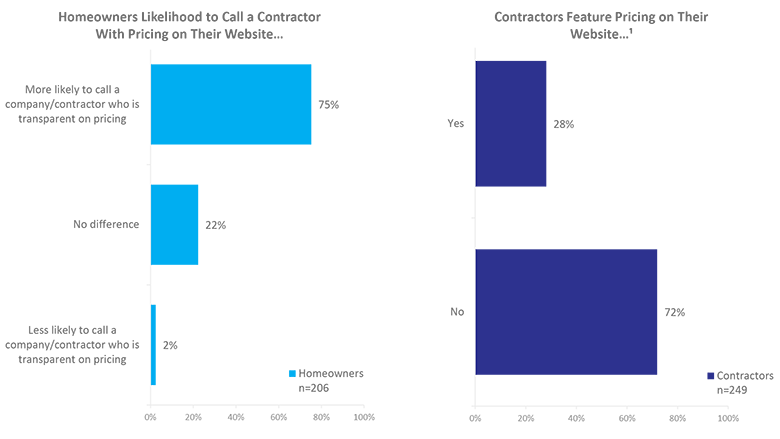

Comparatively, three-quarters of homeowners are more likely to call a contractor with pricing on their website, but only over one-quarter of contractors currently feature pricing on their website.

To Fee or Not To Fee

Homeowners are less likely to get a quote from a contractor who would charge a fee for an evaluation visit. The maximum fee homeowners would be willing to pay is around $40, on average. Nearly one-third of contractors indicate they currently charge an assessment visit fee. Contractors report they charge a fee much higher than homeowner expectations at about $395 on average. Panelist Anthony Nelson Group Facilitator for Pivot My Biz says, charging could very well be a positive toll helping restorers find their ideal client.

The most important factors to homeowners when selecting a cleaning, restoration or remediation company/contractor are contractor reputation, coming in at 90 percent, followed by company licensing/bonding, contractor experience, contractor licensing, and quality of materials/equipment.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!