The Intentional Restorer

Property Restoration Trends: Mergers and Acquisitions

As I reported in 2019, there has been a growing trend of companies in property restoration being collected like infinity stones in Thanos’ glove for various mergers and acquisitions (M&A). While the initial transaction creates a splash, altogether these mergers and acquisitions have received little fare in traditional or social media platforms. Michelle Blevins, writing for R&R, shared a list of transactions in 2019 which included three big acquisitions:

- SERVPRO acquired by Blackstone (March)

- American Securities acquired BELFOR (April)

- FirstService Corporation acquired Interstate and FirstOnSite (May)

While many restorers enjoy being a big fish in a little pond, many of our industries larger fish still pale in scale to the organizations that we all service in the broader insurance and investing landscape. 2020 shown no signs of slowing, even during a pandemic, with regards to mergers and acquisitions in the property restoration industry.

ServiceMaster completed a deal with Roark Capital and BMS CAT acquired Jarvis Restoration, just to name a few of the transactions last year. 2021 opened with a few M&A bangs, including current Restoration Industry Association (RIA) President Mark Springer’s Dayspring Restoration being acquired by Trinity Hunt. A quick search for "merger" on R&R's website shows more acquisition news.

Let’s look at a few of the types of deals, speculate on the impetus for these transactions, and determine if we can uncover principles that are helpful to the everyday restorer.

What is private equity’s (PE) role in property restoration acquisitions?

Private equity starts with a high net worth individual (HNWI) or a firm that wants to grow their money by investing in private companies, or publicly traded ones that they will often delist. Roark’s investment in publicly traded Terminix (TMX) will be interesting to watch from this perspective. Big money is aimed at earning bigger money usually with a “horizon” of four to seven years. Blackstone, which is on the New York Stock Exchange (BX), has stated that their investment in SERVPRO is targeting a longer term play. The mergers and acquisition (M&A) market is hot right now, so many of the top firms and investment banks are constantly looking for deals to generate both high quantity and high quality transactions so that they can stay on top of the mountain.

Investopedia makes this observation, “A highly fragmented industry can undergo consolidation to create fewer, larger players,” which is a factor in what we are seeing in the property restoration industry as equity players continue to make their moves. Already the largest organizations in the industry have been acquired, the writing is on the wall for the squeeze on the “middle class” of the industry.

Interestingly, for more than two years now, RIA as the largest and longest standing trade association for restorers, has been operating under the mantra “fragmented no more.” The onslaught of consolidation may be a rallying cry to those restorers who have struggled to understand the value of collaboration. And yet, at the same time, those in seats of power in the industry have been the ones making the deals.

What is the significance of fragmentation in restoration acquisitions?

To be clear, fragmentation is a precursor to consolidation, but what do these terms mean? Fragmentation often coincides with globalization in products industries but it takes a different meaning in service based industries. “A fragmented industry is one in which many companies compete and there is no single or small group of companies which dominate the industry. The competitive structure of the industry means that no one company is in an overly strong or influential position in the industry.”

In short, as an industry built on independence, our greatest strength is also our greatest weakness. Co-dependence is not the answer, but to reduce the target potential being widened by fragmentation, a bit of interdependence could do us ALL well. It sounds counter-intuitive, but if you value independence, the time to open your ears and efforts to collaboration is NOW if you want to help yourself and your fellow restorers maintain these positions. As Dan Cassara, former CEO of DKI and current CEO of CORE says, “It only strengthens the notion that in order to compete, restorers must have the tools, resources, and network behind them to be successful.”

Why is property restoration as an industry so appealing to investors? There is a huge upside to consolidation; there is a lot of money to be made for those companies that dominate the top of the mountain. If this isn’t clear or humbling enough, author Michael Porter states it this way, “Overcoming fragmentation can be a very significant strategic opportunity. The payoff to consolidating a fragmented industry can be high because the costs of entry into it are by definition low, and there tend to be small and relatively weak competitors who offer little threat of retaliation.”

M&A leads to bigger entities, but the question of whether bigger is better in restoration will be decided by what that accumulated power (and/or influence) is used for. There is also some trepidation as to the intent and impact of private equity. While an “infusion of cash” brings opportunities for rapid growth, as has been observed in other sectors, the debt burden can be cumbersome. We are all aware that there is no free money, but what is the cost of “rapid growth” money?

Restoration Merger and Acquisition Trends: The Big Deals

Bass, Berry & Sims represented the Isaacson family and SERVPRO in their recapitalization partnership with now majority stakeholder Blackstone. According to Matrix Capital Markets Group, recapitalization is a partial sale of the business; “Equity recapitalization transactions enable clients to largely cash out of their investment in the business and capitalize on the enormous amount of sweat equity they have put into their business over the years.”

BELFOR Property Restoration was acquired a month later, and by the end of quarter one in 2019, two of the largest organizations in the industry were in partnership with private equity.

BELFOR is known for its own list of acquisitions, including Masco Corp.'s Inrecon LLC in 2001, which led to immediate growth by acquiring one of the largest restoration organizations in the world at that time. In 2007 BELFOR Holdings Inc. continued their growth strategy and initiated the development of a franchise network by acquiring DUCTZ International, LLC. Between 2009-2013 the company reports that over 100 new offices were opened or (mostly) acquired in North America. I found it interesting that both major acquisitions in 2019 were related to companies that “chase” significant storm related work. Crain’s Detroit Business remarked, “Natural disasters are highly profitable for BELFOR but unpredictable, and insurance companies don't typically reimburse restoration companies until the fourth quarter. That produces a lot of short-term borrowing for operations.”

Access to deeper reserves of capital from an equity investor is an attractive proposition for growth minded management teams as well as those who require financing to pursue high revenue, and potentially high risk, opportunities. For those of us in restoration, acquiring SERVPRO would be a no-brainer as they have invested heavily to develop themselves as the publicly recognized entity in the industry. Restoration contractors respect the diverse portfolio and consistent growth that BELFOR has achieved, but what do our biggest fish look like when they swim in a larger pond with much larger fishes? While the pressure of profit is not exclusive to M&A transactions, what happens to the restoration experiences, voices of collaboration, and industry standards when portfolio growth becomes the guiding principle? It is yet to be seen whether we are witnessing the natural progression of our industry or the consolidation of it by forces much larger, as well as whether these concepts are mutually exclusive.

In 2017, CNBC reported on the growth of opportunities in disaster restoration contracting, remarking that it was, “Highly profitable but hard to break into unless they are franchisees, mostly because there are few publicly traded options.” SERVPRO has built a franchise model with over 1,700 locations nationwide, and as noted, BELFOR has invested heavily in their diverse franchise holdings. Franchise operations provide residual income as well as a revenue platform that scales. Blackstone and American Securities aren’t the first private equity to invest in property restoration but they certainly have made the biggest splashes. What are some of the historic M&A activities in our industry and what do they tell us anything about where we are headed?

Restoration Merger and Acquisition Trends: The Package Deals

Disaster Kleenup International (DKI) started in 1975 when Ed York brought 10 restorers together to form a network and pool resources. One of the founding members, Denny Jensen, reminds readers of the imprint of Mr. York, “If it wasn’t for Ed’s visionary talent, none of us would be here today. He is truly a pioneer, a soothsayer of sorts, for our entire industry.”

In 1994, the company began franchising operations and in 2012 DKI was acquired by Gemini Investors in a recapitalization deal. As noted, recapitalization is described as a medium which allows those who have invested to recoup their sweat equity and help fund their future growth. Whether you intend to sell your business or not, it is often viewed as good business to develop your company in a manner that it would be viable for a merger. There are still many organizations that operate without sound metrics. As we have discussed before, being successful but not understanding why can be as dangerous as being unsuccessful.

M&A: Packaging complimentary services

AdvantaClean was acquired in early 2019 by Home Franchise Concepts (HFC). HFC itself was bought by equity investor Trilantic Capital Partners LP back in 2015, and the purchase of AdvantaClean added to their other home-improvement franchise systems which include Budget Blinds, Tailored Living and Concrete Craft. In October of 2020, ServiceMaster Brands sold to Roark Capital and will rebrand, under the name of the company it acquired in 1986, as Terminix Global Holdings. Roark has a smorgasboard of franchises which it has helped grow including Jimmy John’s, Orangetheory Fitness, and Buffalo Wild Wings. We had the pleasure of discussing The ServiceMaster Story with author Al Erisman on The DYOJO Podcast, which touches on the shift within the company leading up to the changes in vision in the early 2000’s. It is also noteworthy that ServiceMaster and AdvantaClean operate from the franchise model. In recent years there have been organizations that offer some of the benefits of franchise deals without completely giving up independence, including CORE and Restoration Affiliates.

Restoration Merger and Acquisition Trends: Teaming Up

Commenting on their recent merger with a regional partner, Advanced DRI CEO Greg Boatwright shared his thoughts with R&R, “In today’s economy, it is more challenging for small companies to survive and thrive. By combining good companies, we’ve put those resources in place.”

In this vein, companies joining forces may be a means to increase their access to resources, reduce cost of goods, and work jointly to increase their combined footprint in a market. As discussed in our prior article, purchasing power is a key element in reducing expenses for core goods. This increased access benefited Bend, Oregon craft brewer 10 Barrel Brewing Co. which was acquired by Anheuser-Busch in 2014 enabling 10 Barrel to purchase materials at a significantly reduced cost as well as invest more rapidly in expanding locations. That deal is still young, but similar deals have led to increased access for consumers to “craft beer”. And yet, the headline of Budweiser purchasing a Pacific Northwest craft brewery pales in comparison to the icon of American indpendence and longtime best-selling domestic beer being purchased by the Belgian-Brazilian behemoth InBev in 2008.

While I have yet to find a press release where the acquired or the acquiring will say anything negative about the deal, it has been said by many there is no such thing as a merger; there are only acquisitions. Whether a contractor is “teaming” up with another contractor to expand footprint and capacity, or an organization has “partnered” with private equity to accelerate growth, one entity will be the entity. Perhaps some restorers believe that being merged could help them accelerate their vision, but should be cautioned that the acquisition comes with an expectation to meet aggressive sales targets that if not achieved, could leave them with far less than what they expected from their new partners. When there is mutual respect for core competencies and alignment of values, the acquisition may be of overall value to all parties. As this is still fairly new in our industry, one must ask if consolidation is inevitable or if something can be done to maintain a “middle class” for property restoration.

M&A: Teaming Up to Add a Specific Competency

Carpet cleaners hold a key role in the history of evolution into water damage and property restoration services. In March of 2018, HRI Holdings, Inc. acquired Delta Disaster Services. This move added mitigation and repairs service to their existing carpet cleaning franchise services through their Chem Dry brand. HRI was acquired by BELFOR which shows not signs of slowing on their strategic growth through acquisitions. In July of 2020, the company added Patch Boys as their ninth BELFOR Franchise Group brand acquisition. The drywall patch and repair service joins entities such as HOODZ, N-Hance Wood Refinishing, and PACKOUTZ. In early 2021, Advanced DRI, formerly Hudson Valley DKI, merged with A. Molly Company. Both entities will operate under their current names while forming a parent company, Advanced Disaster Recovery Inc. Commercial service focused Cotton Holding, Inc. acquired roofing specialist Stellar Restoration Services.

M&A: Teaming Up for Regional Growth

Tampa-based Kustom US acquired Atlanta based Southern Property Restoration in March of 2018. Jay Clark, Managing Director of LCG Advisors, noted the deal was, “another key milestone to Kustom’s goal of expanding its national footprint through acquisition of established market leading companies.” BMS CAT (aka Blackmon Mooring) started as a privately owned company in Texas in 1948. BMS has been busy in 2020 completing a series of market specific acquisitions including North Carolina based Diamond Restoration in January, Michigan based Jarvis Restoration in July, and Pittsburgh based FireDEX in August. This investment in market growth has been fueled by a capital infusion from BMS Enterprises being acquired by AEA Investors, LP in September of 2019.

While American Technologies, Inc. (ATI) hails as the nation's largest family-owned and operated restoration contractor, the Anaheim-based company received it’s “first external capital infusion” in August of 2020 from TSG Consumer Partners. Following that, in November, ATI Restoration acquired Mark 1 Restoration which has three offices in Pennsylvania and New Jersey.

With seven locations in Montana, Trinity Hunt has dipped their toe in the market by acquiring Dayspring Restoration in late 2020. The firm “plans to acquire two to four add-on companies in the next five to six years,” according to one of the Trinity Hunt principals, Garrett Greer.

Active industry contributor and current RIA President, Mark Springer, remains as CEO and a significant shareholder in the deal. We had the pleasure of talking with Mark about the growth of his company on our podcast, but we did not have the insider information or foresight to ask about this process at that time.

M&A: Teaming Up for Nationwide Growth

Signal Holdings, LLC based in Troy, Michigan, is the parent company of Signal Restoration Services which made a name for itself helping New York City in the wake of Superstorm Sandy. Mark Davis is the current CEO and Chairman of PuroClean; he made an early mark in the industry when he and a partner purchased Rocky Mountain Catastrophe in 1996. RM CAT grew organically and through acquisitions until it was acquired by the Haniel Group as part of the BELFOR landfall in North America in 1999. Mark and Frank Torre partnered to purchase Signal in 2012 and acquiring Tamarac, Florida based PuroSystems, Inc, thereby the PuroClean brand, in 2015. This move facilitated targeting growth through franchising. In an interview with R&R, Mark notes that he observed the value of the franchise system while at BELFOR, “They [SERVPRO and ServiceMaster] were able to do it [growth] with a lot less capital invested because they weren’t actually funding those acquisitions, they were selling franchises.” A year later the group added tri-state restorers, Sentinel Group, LLC in 2016.

Interstate Restoration bolstered their East Coast position by completing an acquisition of InStar in 2012. We are about to unravel an NBA like, multi-team series of acquisitions that will result in a “super team” combining several recognized brands in the U.S. and Canada. The first trade occurs when FirstService Corporation (FSV) acquires Paul Davis Restoration and California Closets 2016. FSV now has a one-star restoration team, with intentions to expand operations in both countries. The second trade occurs when Fort Worth, Texas based Interstate Restoration, LLC acquires Canada’s largest independent restoration service provider, FirstOnsite Restoration G.P. in 2016. Global Restoration Holdings, LCC (GRH), is the parent company formed from the formation of this two-star restoration team, which also has operations in both countries. FirstService, with the help of Delos Capital, acquires GRH and completes their three-star restoration team. Just in case you missed these details, here is our quick synopsis:

- The Canadians (FSV) acquired Paul Davis in 2016 (one star);

- The Americans (Interstate) acquired FirstOnSite also in 2016, and they form GRH (two stars);

- Not to be outdone, the Canadians (FSV) purchase GRH and plan to rebrand all as First Onsite (three stars).

This deal looks to be similar to the Blackstone deal with SERVPRO in the sense that FirstService Corporation operates a property management wing, FirstService Residential, and services wing, FirstService Brands which include franchise and company-owned operations. As of May 2019, FSV owns three restoration brands, Interstate, FirstOnSite, and Paul Davis. Jeff Johnson, Executive Chairman of Global Restoration, commented, “With the backing and credibility of a highly-regarded, large public company, we are now well-positioned to accelerate our growth for many years to come.” The team continues to grow as acquisition deals following the 2019 “big deal” include ASR (California), CATCO (Missouri), Perfection (Illinois), Rolyn (Maryland), and JPL (Quebec).

BluSky Restoration Contractors, LLC (Denver, CO) merged with HARBRO Emergency Restoration, Inc. (Signal Hill, CA) in mid 2020, with both companies branding under the BluSky name. The company describes the deal as combining complementary core competencies, “Including HARBRO’s significant mitigation experience and BluSky’s robust reputation for reconstruction work.” HARBRO adds West Coast locations to the prior acquisitions from BluSky including Disaster One in 2017, United Services in 2019, and SRP Contractors in 2020.

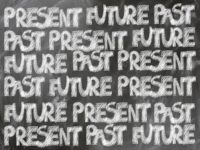

Restoration Merger and Acquisition Trends: Consolidation is Present

If you read the press releases, all of these deals are “exciting” as they are “mutually beneficial” and fulfill “long term growth goals.” These aren’t consolidation, they are collaboration, right? If Company A is doing well and Company B is doing well, the combined Company AB will be even better, right? S&P Global released a report on mergers and acquisitions in 2016 stating, “While acquiring-company management almost universally tout expected “synergies” and efficiency gains, our research shows that, on average, such synergies either do not exist or are only realized over an extended time horizon (i.e., well over three years).” If you read the full report you might ask yourself, why would anyone pursue M&A deals? Yet, if 2020 has taught us anything it’s that the rules don’t apply, history is bound to repeat itself, and private equities interest in our industry isn’t going away any time soon.

Harvard Business Review (HBR) released a report in 2002 that charted an average of 25 years for an industry to cycle through consolidation. Reading this report, the strategy executed by companies such as BELFOR makes even more sense and explains why there has been a surge in M&A deals as of late. The HBR definition of Stage 3 is rather prescient,

- After the ferocious consolidation of stage 2, stage 3 companies focus on expanding their core business and continuing to aggressively outgrow the competition.

- The top three industry players will now control between 35% and 70% of the market.

- By this time, there are still generally five to 12 major players.

While we did not mention all of the deals that have happened, we did cover the majority of them which included: BELFOR, SERVPRO, FirstService, Interstate, ServiceMaster, Blusky, Paul Davis, PuroClean, BMS Cat, ATI, DKI, and more. One thing should be clear, the question is not whether consolidation will happen for the restoration industry but how far it will extend. This heightens the pressure to “grow or die” which is prevalent in all business sectors. What then can you do if you don’t want to “sell out”, be absorbed, or be left in the dust?

First, are M&A deals really selling out?

How many businesses can say, with confidence, that if a private equity were to do more than peek under the hood of your organization that they would make an offer that is anywhere near the worth of your company that you have in your head? It is surprising how many owners operate from the ledger sheet that only exists in their own brain. Eric Sprague and Larry Wilberton shared the value of building their business in a manner that it could be sold while guests on Josh Zolin’s Blue is the New White podcast. You may find that your business is worth more than you thought, or you may find that you have more work to do. Don’t waste this moment, as Kevin Hussey shared with our DYOJO Podcast audience, get to know your numbers intimately. Knowledge is power as it creates a foundation for understanding your value, being able to seize opportunities, and making good decisions.

Second, is consolidation inevitable?

Yes. It’s already here. The biggest fish in our pond are merged and swimming with bigger fish in bigger ponds. Look at most industries in the United States; there are the big corporate outfits and there are the smaller mom-and-pops, the area most impacted is often the middle of the industry. This is no surprise and it isn’t something new.

Writing for Vox, Eileen Appelbaum, a senior economist at the Center for Economic and Policy Research and an expert on private equity states, “Yes, the markets are changing. Yes, competition is difficult. But if you can retain your own resources and make the necessary investments, yes, you can compete.”

If you want to remain independent, I would argue that you will need to embrace collaboration so that you can achieve some of those benefits of consolidation without giving up all of your autonomy. Find organizations that are working for the good of all and invest in them. You can complain about reality or you can work to improve it. Efforts such as RIA’s Advocacy and Government Affairs (AGA) Committee show a lot of promise for making an impact for the industry as a whole. From speaking directly with Mark Springer, the RIA is aware of it’s past perceptions and is working to better represent the everyday restorer. Collaboration requires giving of yourself and your immediate goals to attempt to achieve greater long term outcomes; maybe it is time for you to get involved.

Third, adaptation is always necessary.

Whether you work in the corporate world or you own your business, year after year the squeeze gets tighter as we must do more with less. If you read the Harvard report previously referenced, there is a predictable trajectory with a rapid progression. The authors of the HBR article close with this statement, “Most companies simply won’t survive to the endgame by trying to stay out of the contest, or worse, by ignoring it.”

Aside from the unintentional “Endgame” pun which ties back to my opening Thanos reference, we know for certain that burying your head in the sand, or joining the ranks of the social media keyboard warriors who solely vent on issues, will not help you feed your family. There has never been a time when property restoration was easy, but there also has never been a time when we have more access to people, resources, and opportunities to work together. Free groups like NORRP and Restoration Rebels have created widely utilized platforms for restorers to share their challenges and crowdsource solutions. It is encouraging to know that you are not alone. Once you know how to survive, it is important to contribute to the greater good.

In conclusion, I don’t have a conclusion. Mergers and acquisitions have been an internal component of the fabric of our industry from the beginning. The emergence of private equity interests indicates that bigger money sees opportunity in our enchanted forests, but also brings “outside” influence that will forever change the landscape. You have to do what is best for you, but it is important to remember that short term objectives should not undermine long term goals. I think it is important to realize that no organization or process is perfect, so if you are on the fence about pitching in with efforts within our industry to improve it, don’t let their fallibility hold you back.

Do your own research, make your own opinions, and give it a shot.

Henry Ford speaks to every generation, especially ours when he says, “Coming together is a beginning, staying together is progress, and working together is success.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!